Investment services have continuously been shifting online in recent years. With the help of mobile investing experience, stock portfolio trading is now simpler and more convenient than ever before. However, having access to simplified investment experience does not necessarily translate to better investment performance.

Common difficulties faced by new and casual retail investors include limited access to market information, inability to assess investment opportunities, and lack of knowledge/tools to analyze complicated data and keep their portfolios well-managed.

Fortunately, there are several stock apps out there that come in handy when making or managing investments.

Stock Trackers Help you Understand Investment Performance

Recommended Free Tools: Excel / Google Sheet, Ticker, Planto

The most traditional stock tracker is Excel or Google sheet. You can manually add data such as stock name, ticker, number of shares, buying/selling price, and fees/commissions, these data will then allow you to calculate the return of each investment.

While Excel / Google sheet option is the most manual and time-consuming, it also gives you the flexibility to include and sort information in any way that you prefer or think is the most useful. Once all the information and calculations are in place, you can do further analysis or plot out trends and examine whether the return is in line with your expectations.

👉Download and try the stock tracking Google Sheet we have made.

For investors who do not want to manage a spreadsheet or prefer an automated stock tracker, a mobile app called “Ticker” is a popular option among many local investors. With Ticker, users only need to enter information like the ticker, number of shares, buying/selling price, and fees of each transaction, Ticker app will then calculate the realized and unrealized profit of your portfolio automatically. One drawback of the Ticker app however is that it does not provide tracking for U.S. stocks.

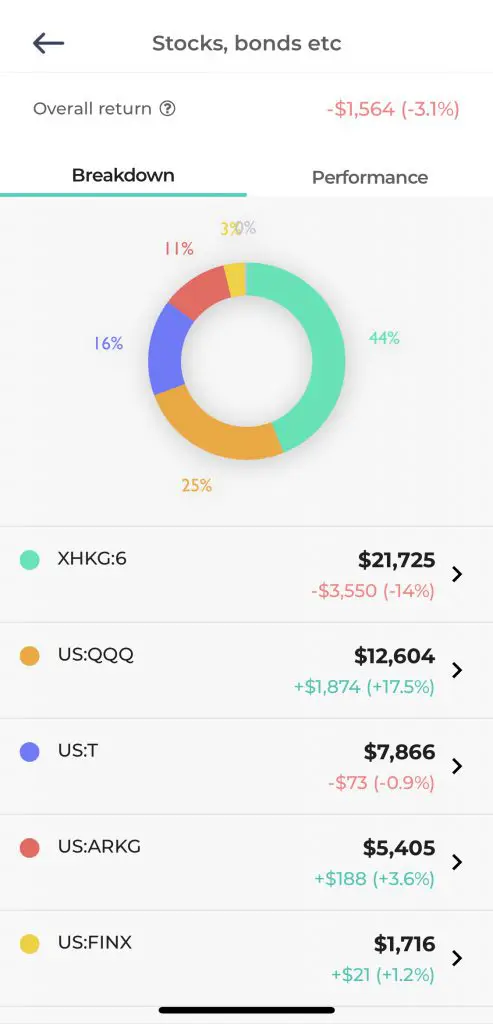

If you are looking for the ultimate convenience, Planto app helps you to automatically track all kinds of investment assets including stocks and MPF – simply link your securities or investment accounts to Planto, then the system will automatically convert your Hong Kong and U.S. stock portfolio into charts, making it easy for you to understand your performance at a glance.

Planto app currently supports more than 20 investment providers including SoFi HK, Futu, Aqumon, Interactive Brokers, HSBC, Citi Bank, Bank of China (Hong Kong), and many more.

| Stock tracking tool | Adding of transaction(s) | Supporting instrument | Ease of use |

| Excel / Google sheet | Manual | Hong Kong stocks, U.S. stocks and any other asset | Relatively complex |

| Ticker | Manual | Hong Kong stocks | Simple |

| Planto | Automatic | Hong Kong stocks, U.S. stocks, time deposit, MPF etc. | Simple |

Access News & Information on the Stock Markets

Recommended Tools: Futu Securities and other Major Financial Information App

Hong Kong investors typically use AASTOCK, HKET, and other apps/websites for information on the market and stock trends, however contents on such channels mostly focus on local trends and opinions. While the primary function of mobile applications from securities brokers such as Futu Securities and Valuable Capital is to facilitate stock trading, these mobile applications are also equipped with comprehensive news, intelligence, and stock screening features. Such mobile apps also have social features that allow investors to communicate and learn from each other, making them convenient platforms for accessing information.

For investors who mainly focus on the U.S. stock market, they may find local information platforms lacking as information is typically updated less frequently during trading hours which is caused by time zone difference. If you are looking for a reliable source of real-time information on the U.S. market, international platforms that focus on the global financial market may be more suitable for you.

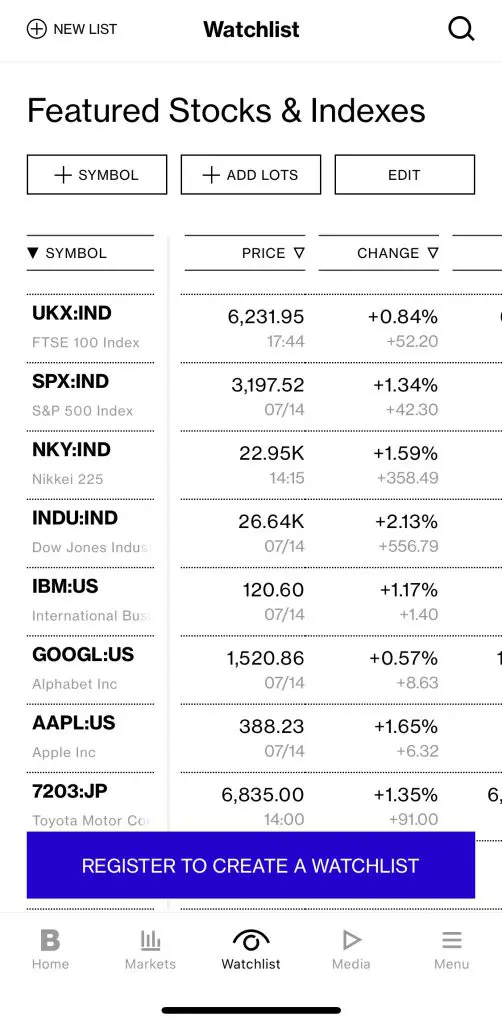

If you do not mind paying subscription fees, Bloomberg can offer real-time information, news, and content on the financial markets globally. Bloomberg also has a Watchlist feature which can help you to build and track stocks in Hong Kong, U.S., Japan, U.K. and many more, this feature from Bloomberg is free and is easy to use. Bloomberg’s alternatives include Reuters and Investing.com.

Compare U.S. Investment Brokers

Recommended Readings:

Recommended Readings

- Welcome Offer Comparison: Get Free Blue-Chip Stocks With New Investment Accounts

- Investment Strategy Guide to building a diversified portfolio

- Valuable Capital Review: Commission-free HK stock trading, free real-time quotes

- Futu Securities Review

- Saxo Bank Review: A Simple Offshore Banking & Trading Solution for Hong Kongers

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.