People who love to travel are always thinking about their next getaway. Unfortunately, before the getaway really begins, you have to spend money to buy your flight. Luckily, there’s quite a few credit cards which make it easier on your pocket – we’ve shortlisted the four best credit cards to get miles faster.

In short, the best cards are:

- DBS Black World MasterCard

- Standard Chartered Asia Miles MasterCard

- Citi PremierMiles

- American Express Cathay Pacific Elite Credit Card

Read on to see why we think they’re the best:

DBS Black World MasterCard

If you have an annual salary of more than HK$ 240,000, this could be the card for you. Even though the card is pretty good for spending locally in Hong Kong, it’s even better if you plan to spend abroad with it – local spending gives you 1 mile / HK$ 6, and overseas spending gives you 1 mile / HK$ 4.

DBS$ can be exchanged for either cash back or for a few different kind of frequent flyer programs like Asia Miles, KrisFlyer, Avios or Phoenix Miles.

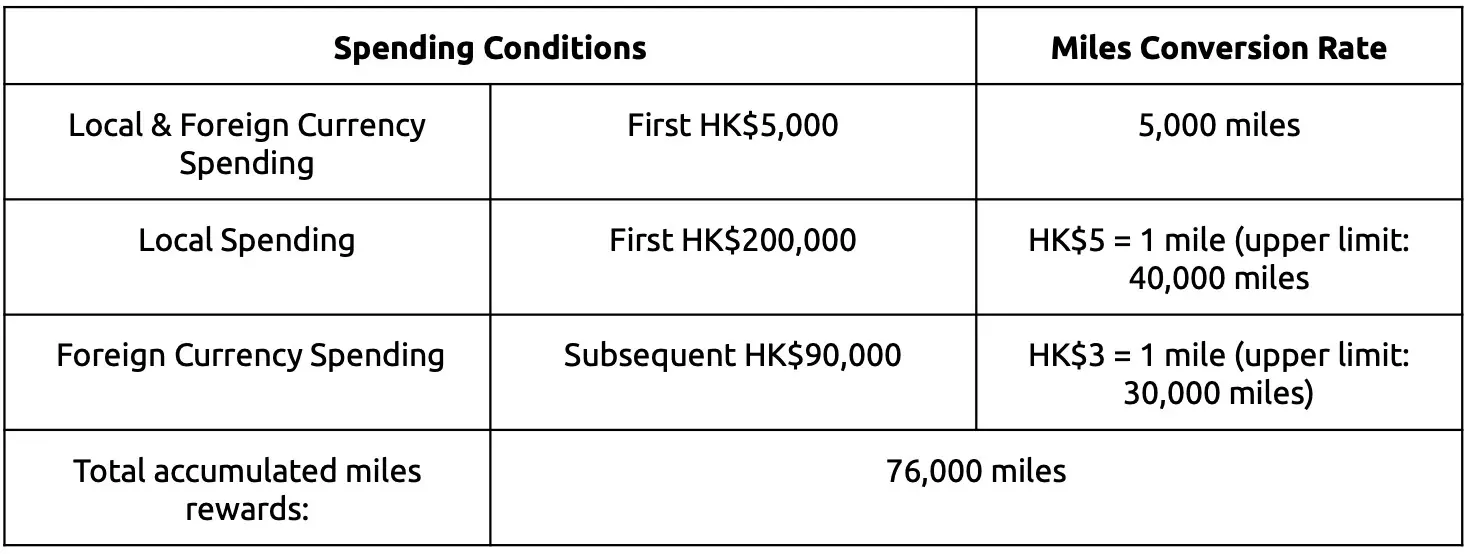

The welcome offer gives preferential rate on miles as well – here’s how it works:

No result found

Input a higher salary for more cards

Standard Chartered Asia Miles MasterCard

Unlike the DBS Black World MasterCard, Standard Chartered’s Asia Miles MasterCard has a much lower salary requirement (HK$ 96,000 per year only) making it a very suitable starter card. Local restaurants, overseas & online spending all get you 1 mile / HK$ 4, and all other eligible spending gives you 1 mile / HK$ 6. Probably best of all, they automatically redeem each month into your Asia Miles account without any conversion fees!

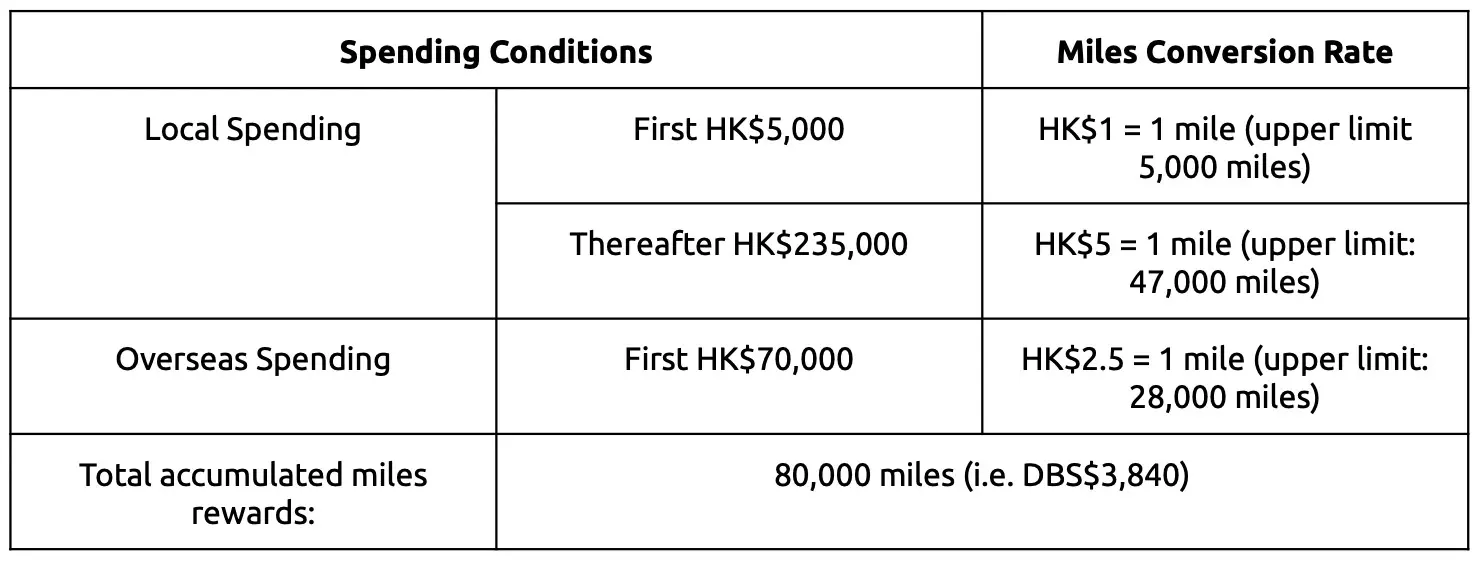

Just like the DBS Black World MasterCard, this card also has preferential rates on miles as part of the welcome offer – this is what it adds up to:

No result found

Input a higher salary for more cards

Citi PremierMiles Credit Card

The Citi PremierMiles Credit Card requires an annual salary of HK$ 240,000. It’s quite good for people who spend overseas or in foreign currencies a lot. Local spending gives you 1 mile / HK$ 8 which isn’t great compared to the others.. but if you spend more than HK$20,000 each month, you get 1 mile / HK$ 3 for overseas & foreign currency spending. If you spend less than HK$ 20,000 each month, you still get a great 1 mile / HK$ 4 for overseas & foreign currency spending.

In addition to that, 12 ‘free’ airport lounge services are provided each year, but you need to spend $5,000 within 30 days after each usage of the airport lounge.

The card also has a great welcome offer for new customers – if you spend more than HK$ 10,000 within 2 months of card issuance, you can choose:

- HK$ 800 supermarket cash coupon; or

- HK$ 700 SOGO cash coupon, or

- Hong Kong Mandarin Oriental Hotel Double Afternoon Tea

No result found

Input a higher salary for more cards

American Express Cathay Pacific Elite Credit Card

The American Express Cathay Pacific Elite Credit Card application requires a slightly higher annual salary of HK$ 300,000. The card is great for frequent travellers since you get to use the Plaza Premium Lounge around Asia for the whole year, and you get decent rewards – 1 mile per HK$ 6 for local spending and 1 mile per HK$ 4 for overseas spending.

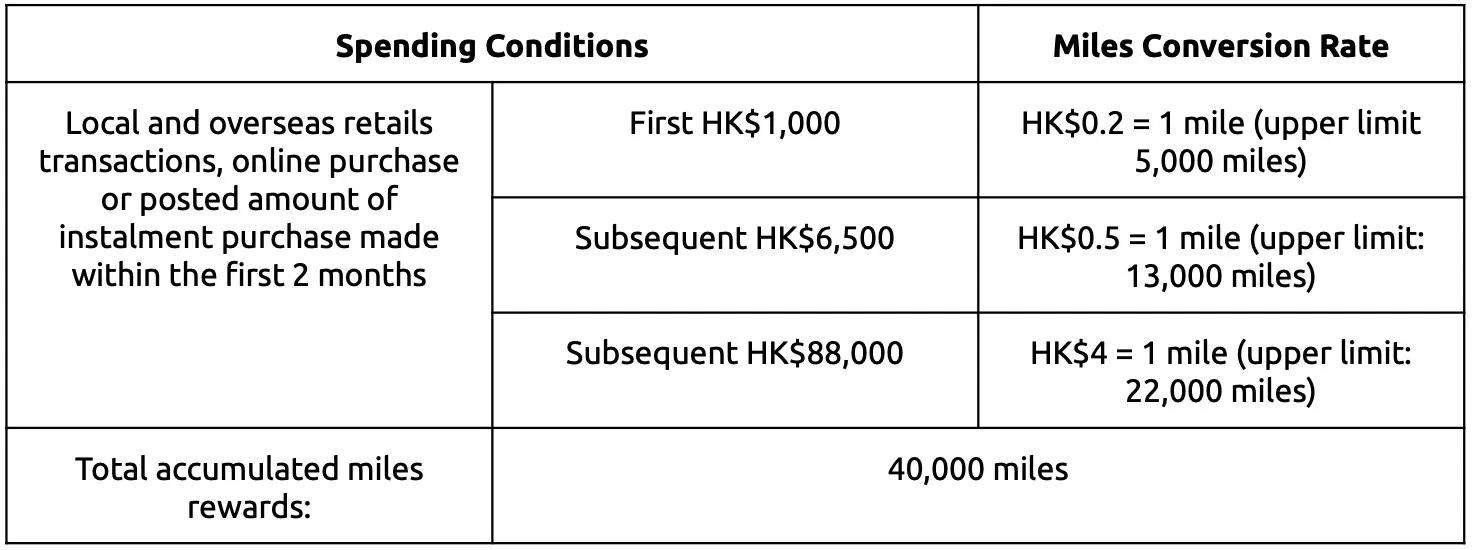

The AMEX Cathay Pacific Elite Credit Card also gives some preferential treatment as part of the welcome offer, alongside a 1000 mile granted on application: